PRODUCTS

QUALITY FINANCIAL PRODUCTS THAT SUIT YOUR LIFESTYLE

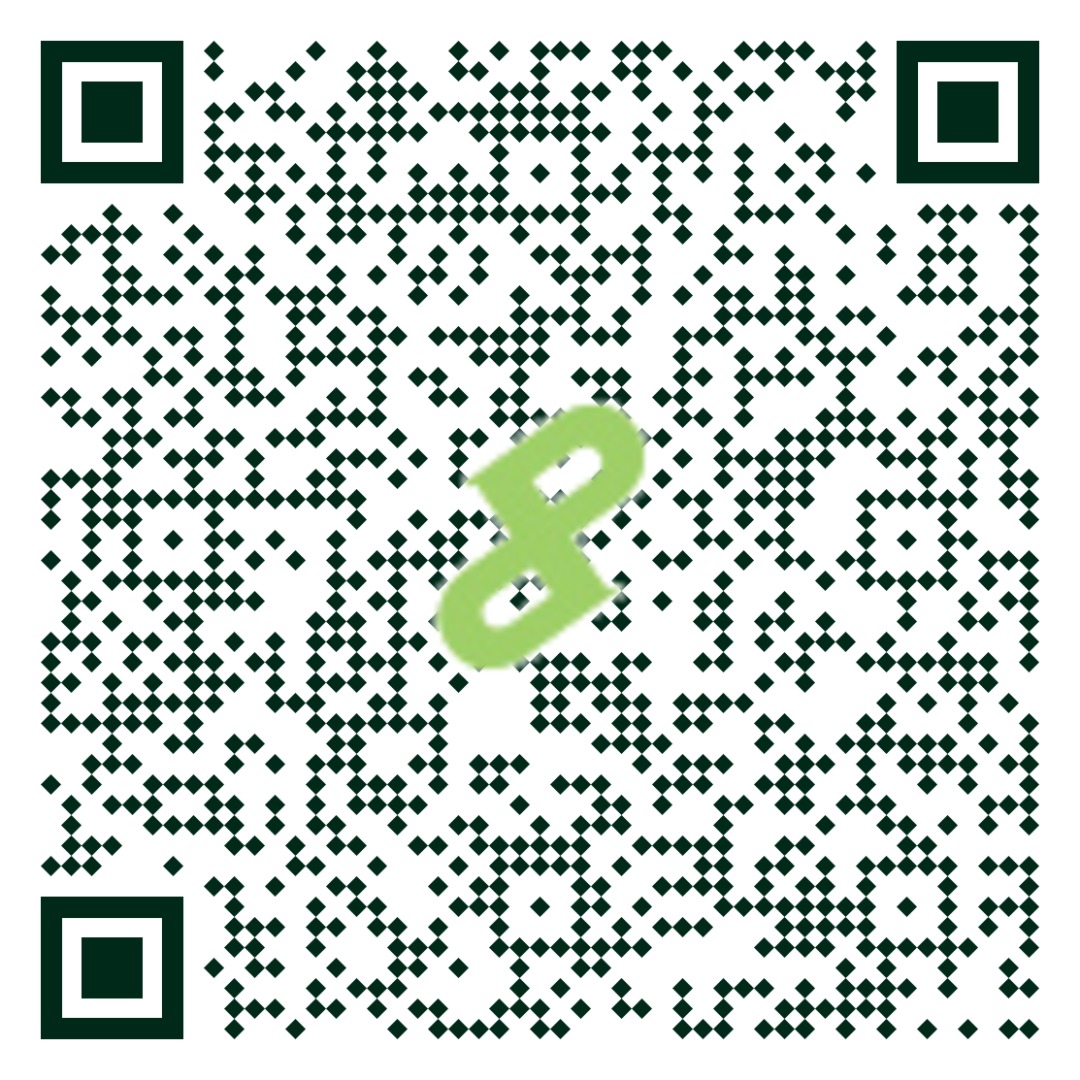

Payment Channels

CONVENIENT & WIDE REACHING PAYMENT CHANNELS

DEALER

LOGIN

LOGIN